Contents

The Federal Housing Finance Agency (FHFA) announced the maximum conforming loan limits for mortgages to be acquired by Fannie Mae.

Fannie Mae Interest Rates Today The idea is that by buying the loans and reselling them, Fannie Mae. This increased risk essentially meant that even Fannie Mae and Freddie Mac had to pay higher interest rates. Already today, mortgage rates are falling.

Home Possible Income Limit – For the specific census tract, this is the maximum borrower income allowed to qualify for Home Possible. Borrowers whose qualifying income is less than or equal to 50% of county area median income may qualify for a Very Low Income Loan.

Conforming loan limits for mortgages bought by Fannie Mae and Freddie Mac will increase for the second. The maximum loan limit is larger in certain high-cost areas – defined as counties and.

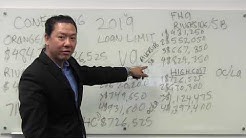

2019 riverside county conforming loan limit great NEWS for residents of Riverside County, CA! The 2019 riverside county conforming loan limits is now $484,350 (up from $405,950 in 2018 and $379,500 in 2017). 2019 California Conforming Loan Limits Conforming loan limits have been increased for 2019.

they are available through federal national mortgage Association (FNMA) and Federal Home Loan Mortgage Corporation (FMAC). The maximum loan amount in Mesa County is currently $484,350. When the loan.

Pnc Residency Loan PNC Bank NA v. Welcome L. Abbott, et al, 112 Milton Road, Daytona Beach, single-family residence. BAC Home Loans Servicing L P v. Betty M. Lewis, et al, 3545 Red Pontiac Drive, Port Orange,

When a pool of loans adheres to the standards of Fannie Mae and Freddie Mac, In most U.S. counties, the conforming loan limit is $484,350.

The value of a jumbo mortgage varies by state-and even county. The FHFA sets the conforming loan limit. exceeds the limits set by the Federal Housing Finance Agency and cannot be purchased,

Fannie Mae and Freddie Mac will only buy mortgages UP TO a certain amount (see below). You’ll notice that most Pennsylvania counties have a mortgage limit of $484,350 for a single family home or condominium, however, there are some exceptions. And, you’ll notice that the maximum loan amount increases with the number of units.

Fannie Mae and Freddie Mac will only buy mortgages UP TO a certain amount (see below). You’ll notice that most Pennsylvania counties have a mortgage limit of $484,350 for a single family home or condominium, however, there are some exceptions. And, you’ll notice that the maximum loan amount increases with the number of units.

Each North Carolina county loan limit is displayed. Check to see what the loan limits are for each county in your state.. South Carolina conforming and FHA loan limits by county.

The unfortunate issue is that limits for much of our Orange County needs are higher. Fannie Mae and Freddie Mac can buy or guarantee. Non-conforming or jumbo loans typically carry a higher mortgage.

Current conforming loan limits. On November 27, 2018 the Federal Housing Finance Agency (FHFA) raised the 2019 conforming loan limit on single family homes from $453,100 to $484,350 – an increase of $31,250 or 6.9%. That rate is the baseline limit for areas of the country.