Contents

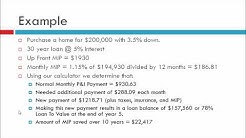

The upfront premium is pretty straightforward. Most borrowers who use the FHA loan program to buy a house will end up paying 1.75% of the base loan amount for their upfront MIP. The annual premiums are more complicated. So we’ve created some 2019 annual FHA MIP charts to help reduce confusion. In depth: Insurance requirements for this program

It’s been a breakneck couple of weeks in the reverse mortgage. to mortgage insurance premiums and principal limit factors, counselors and lenders are preparing for the coming wave of borrowers.

It’s been a breakneck couple of weeks in the reverse mortgage. to mortgage insurance premiums and principal limit factors, counselors and lenders are preparing for the coming wave of borrowers.

WASHINGTON — The incoming Trump administration is likely to postpone a 25-basis-point reduction in the federal housing administration’s annual mortgage insurance premium. Homebuyers also pay a.

At a glance: Most FHA borrowers pay an annual MIP of 0.85% for the full term of the loan, or up to 30 years. FHA mortgage insurance premiums (MIPs) can be.

– When buyers are approved for FHA home loans, they are required to carry mortgage insurance. That includes both a Mortgage Insurance Premium (MIP) and.

This extra cost is the mortgage insurance premium, also called upfront mortgage insurance (UFMIP). The mortgage insurance funding fee is sent to the FHA/HUD after closing/settlement by the lender. Lenders must submit the upfront MIP within 10 calendar days of the mortgage closing or disbursement date, whichever is later.

First, if you pay upfront points when you get your mortgage. Next, the question of whether private mortgage insurance payments are deductible is still an open question for 2017. Late last year,

203K Loan Rates 2015 Mortgage rates were already hovering near 2015 highs as of yesterday. Today’s spike sent them easily above the previous annual high, set on June 10th. Normally, day to day market movement isn’t big.

FHA Reduces 2017 Mortgage Insurance Premiums. The FHA is dropping their monthly mortgage premium insurances to their lowest levels in.

I bought a house through a FHA Loan in April 2017, and I paid around 9800$ as up-front Mortgage Insurance Premium. How can I claim this as a deduction for the year 2017

APPENDIX 1.0 – MORTGAGE INSURANCE PREMIUMS Upfront Mortgage Insurance Premium (UFMIP) All mortgages: 175 basis points (bps) (1.75%) of the Base Loan Amount. Exceptions: Streamline Refinance and Simple Refinance mortgages used to refinance a previous FHA-endorsed mortgage on or before May 31, 2009 Hawaiian home lands (section 247)

Fha Government Agency Unclaimed HUD refunds are owed hundreds of thousands of homeowners who have or had FHA insured mortgages. Each year the Federal Housing Administration (FHA), the government agency which insures mortgages made by local lenders, estimates the number of defaults it will likely experience.

2 Mortgagee Letter 2017-07 Affected Topics This guidance affects appendix 1.0 -mortgage Insurance Premiums of the FHA Single Family Housing policy handbook 4000.1.