Contents

A total of 6,659 new and resale houses and condos sold in the nine-county Bay Area in November. in mortgage money from lenders last month. Jumbo loans, mortgages above the old conforming limit of.

A total of 8,264 homes closed escrow last month in the nine-county Bay Area. 36.9 percent in April and up from 31.3 percent a year ago. Jumbo loans, mortgages above the old conforming limit of $417.

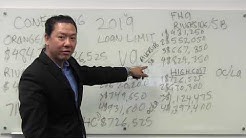

non conforming loan lenders fnma county loan limits current conforming Loan Limits. On November 27, 2018 the Federal housing finance agency (fhfa) raised the 2019 conforming loan limit on single family homes from $453,100 to $484,350 – an increase of $31,250 or 6.9%. That rate is the baseline limit for areas of the country where homes are fairly affordable.U.S Mortgages – Rates See the Biggest Fall since 2009 – origination fee) for 80% LTV loans. Average interest rates for 30-year fixed with conforming loan balances. march adp nonfarm employment change and ISM non-manufacturing PMI numbers are due.Fannie Mae Fha Loan Fnma County Loan Limits conforming loan Refinancing to a non-conforming home loan – Refinancing can get you a competitive interest rate on your current mortgage or free up some extra cash, and while it can sometimes be more difficult for borrowers with bad credit, it is still a very.Loan Limits for 2018 Are Increasing – Freddie Mac – As a reminder, actual loan limits for certain high-costs areas, as determined by FHFA, may be lower than the maximum high-cost area limits identified above. If you are originating super conforming mortgages, it is important you check the loan limits for the specific county where the property is located.Fannie Mae-Freddie Mac Condo Guidelines And Requirements. Both Fannie Mae and Freddie mac condominium guidelines are similar. Freddie Mac and Fannie Mae eligibility requirements allow 3% down payment condo purchase conventional loans to borrowers who qualify on owner occupant condos. Second home condos require 10% down payment.What Is The Jumbo Loan Limit People in New York, Massachusetts, California and other high end regions should brace for less demand and higher interest rates for mortgages above the conforming limit. This is the jumbo mortgage.

From 2015 to 2016, the conforming loan limits for Alameda County were kept the same, with no increase. But there’s a chance FHFA will increase the caps for 2017, in response to the home-price gains mentioned above.

The 2019 VA loan limit increased to $484,350 from $453,100 except in 199 high cost counties where they are higher. This represents a 6.9% increase this year.

Conforming loan limits 2019 in California. In 2019 Fannie Mae and Freddie Mac have purchase limits for California. Mortgage loans at or below these limits are known as "conforming" loans, because they conform to the lending limit.

Conforming loan limits 2019 in California. In 2019 Fannie Mae and Freddie Mac have purchase limits for California. Mortgage loans at or below these limits are known as "conforming" loans, because they conform to the lending limit.

2019 Riverside County Conforming Loan Limit GREAT NEWS for residents of Riverside County, CA! The 2019 Riverside County Conforming Loan Limits is now $484,350 (up from $405,950 in 2018 and $379,500 in 2017). 2019 California Conforming Loan Limits Conforming loan limits have been increased for 2019. The Federal housing finance agency (fhfa) announced the new loan limits on.

Local Loan Limits – Alameda County, CA Loan Limit Summary. Limits for FHA Loans in Alameda County, California range from $726,525 for 1 living-unit homes to $1,397,400 for 4 living-units. Conventional Loan Limits in Alameda County are $726,525 for 1 living-unit homes to $1,397,400 for 4 living-units. The 2019 Home Equity Conversion Mortgage (HECM) limits in Alameda County is.

Alameda County FHA loan limits will go up in 2017, in response to home price increases that occurred over the last year. The maximum loan limit for a single-family home in Alameda County will go up to $636,150 in 2017 (an increase of more than $10,000 from the 2016 limit of $625,500).

County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit 01 001 AUTAUGA AL. Fannie Mae and Freddie Mac Maximum Loan Limits.

VA Loan Limits for High-Cost Counties: Updated for 2019. The maximum guaranty amount for loans over $144,000 is 25 percent of the 2019 VA county loan limit shown below. Veterans with full.

The table below shows the conforming loan limits for all California counties in 2019.. the conforming loan limits for “higher-cost areas” such as San Francisco and orange county.. alameda, $726,525, $930,300, $1,124,475, $1,397,400.