Contents

Refinance Rates On Rental Property Increased supply in the rental market has put property managers in a tough spot. offers security deposit loans of up to $1,000, with a 5% interest rate over a maximum period of three years. Renters.Mortgage Rates 10/1 Arm On Friday, Aug. 2, 2019, the average rate on a 30-year fixed-rate mortgage fell four basis points to 4.02%, the rate on the 15-year fixed was unchanged at 3.59% and the rate on the 5/1 ARM fell.

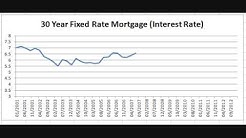

The average 30 Year Mortgage Interest Rate for the last 12 months was 4.58%. The average rate over the last 10 years was 4.19%. Higher rates over the last 12 months compared to the average rates over the last 10 years serve as an indicator that the long term rate trend in 30 Year Mortgage Interest Rates is up.

According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average hasn’t budged for three. Bankrate.com, which puts out a weekly mortgage rate trend index, found the.

30-Year vs. 15-Year Fixed-Rate. Average interest rates for 15-year fixed-rate mortgages have followed the same historical trend as 30-year mortgages, with rates for both remaining historically low. However, interest rates on the 30-year loans have always been slightly higher.

The average 30-year fixed mortgage rate fell to 3.74%, down 5 basis points from 3.79% a week ago. 15-year fixed mortgage rates fell 2 basis points to 3.11% from 3.13% a week ago.

The average for the month 4.48%. The 30 Year mortgage rate forecast at the end of the month 4.55%. Mortgage Interest Rate forecast for August 2021. Maximum interest rate 4.96%, minimum 4.55%. The average for the month 4.72%. The 30 Year Mortgage Rate forecast at the end of the month 4.82%. 30 Year Mortgage Rate forecast for September 2021.

Next Federal Interest Rate Hike Federal Reserve officials held a key interest rate steady Thursday and appeared to stay on course for another hike next month despite criticism from President Trump and a new concern about business.

View timely mortgage rate trends data at realtor.com Mortgage. Search local rates in your area and learn which factors determine your mortgage interest rate.

Rates displayed are AmeriSave’s historical 30 year fixed, 15 year fixed and 7 year adjustable rates. Rates shown do not include additional fees/costs of the loan. These are rates that have been previously available during the indicated time period and not an indication of what is available today.

The average rate on a 30-year, fixed-rate mortgage is 3.56%. For American consumers, meanwhile, the trend toward lower.

The average rate on a 30-year, fixed-rate mortgage is 3.56%. For American consumers, meanwhile, the trend toward lower.

Yahoo Finance’s Morning Brief newsletter has been revamped! With fresh insights and commentary from reporter Myles Udland and editor Sam Ro.

Todays Prime Lending Rate This story requires our BI Prime membership. Delinquencies on mobile-home loans have increased by 2 percentage points over the past year, according to research cited by UBS. The rising delinquency.

For example, many borrowers who select a 30-year fixed-rate mortgage refinance well before even 10 years have passed. Of the fixed-rate mortgages, 30-year terms generally have the highest interest rates and total interest costs, and the longer term builds equity more slowly than would a 20- or 15-year term.